Do We Need to Sign Excel Spreadsheet Itr2 Before Uploading Return India

When you lot file income tax render (ITR) using the

utility, instead of filling the entire Excel form manually, you tin import some of your personal and revenue enhancement details into the ITR Excel course automatically using the XML file, which tin be downloaded from the tax due east-filing portal.

Once you accept downloaded the XML file, yous need to import the file in the appropriate ITR Excel utility/form and the details become pre-filled in the detail ITR Excel course. However, call back only some of the details required to exist filled in your ITR will get pre-filled equally the income tax department'south software will copy these details from your previous ITR and other sources it has access to such every bit your Form 26AS.

Make sure you have downloaded the appropriate ITR'south Excel utility form from 'IT Return Grooming Software' tab on the income tax section's east-filing website before downloading the prefilled XML file.

Hence, you need to offset download the appropriate ITR Excel utility and so the prefilled XML file to successfully complete the procedure of ITR filing.

Here's how y'all can download the ITR Excel utility via the income tax department'south e-filing website. Further, to download the prefilled XML to prefill the personal and tax details in the ITR excel utility, follow steps from 5 to 12.

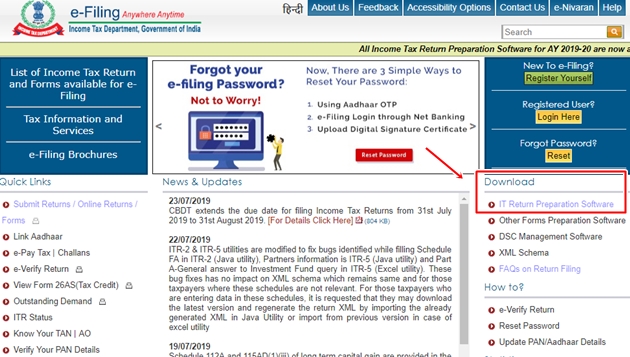

Footstep 1: Visit the income tax e-filing portal, that is, incometaxindiaefiling.gov.in website. Get to the 'Download' section and click on the 'Information technology Return Training Software'.

ET Online

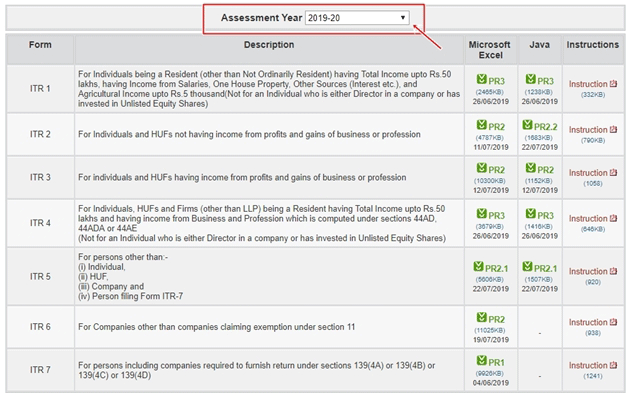

ET Online Footstep 2: After clicking on the 'IT Return Preparation Software', yous will be redirected to 'Income Tax Utilities' screen, select the cess yr and click on the appropriate ITR's (i.e., the ITR form number which is applicative to yous) Excel utility hyperlink.

ET Online

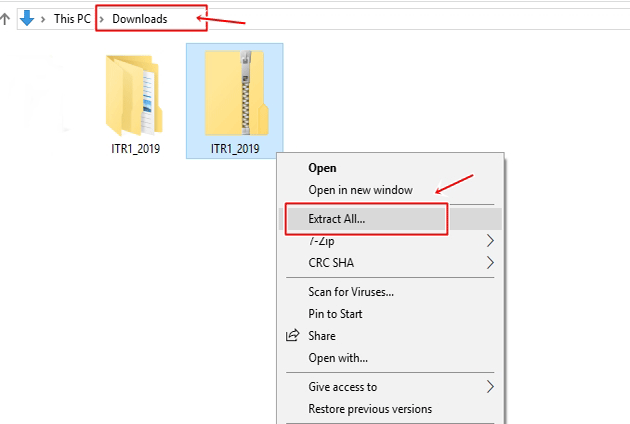

ET Online Step 3: When you click on the ITR grade number you desire to download, the ITR Excel utility naught file volition automatically get downloaded in the 'Downloads' binder of your organization. From the download folder, right click on the downloaded zip file and and so click on 'Extract All' option.

ET Online

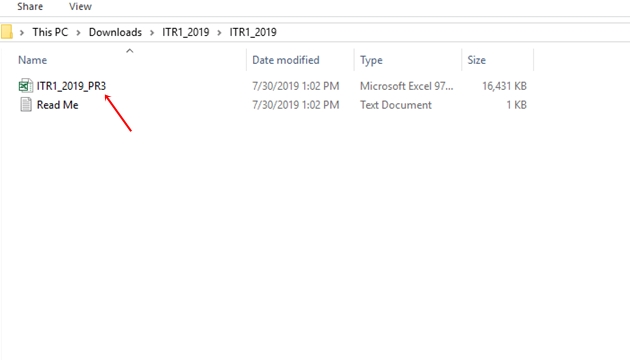

ET Online Step 4: Open the binder to which the nix file is extracted. Double click on the 'Excel File' to open up the ITR Excel utility. Keep the ITR Excel ready before you download and import the personal and tax details from prefilled XML file to the ITR Excel form.

ET Online

ET Online Now, here'due south how you can download and import the prefilled XML file post-obit steps from 5 to 12:

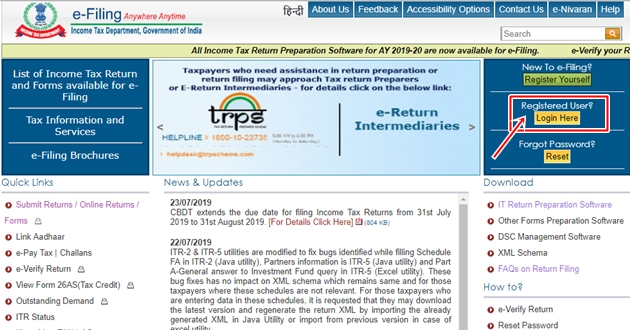

Step 5: Visit incometaxindiaefiling.gov.in website again, nether 'Registered user' option, click on 'Login hither' tab.

ET Online

ET Online Pace 6: The taxpayer has to enter his/her User ID (their PAN number), password, captcha code and so, click on the 'Login' tab.

ET Online

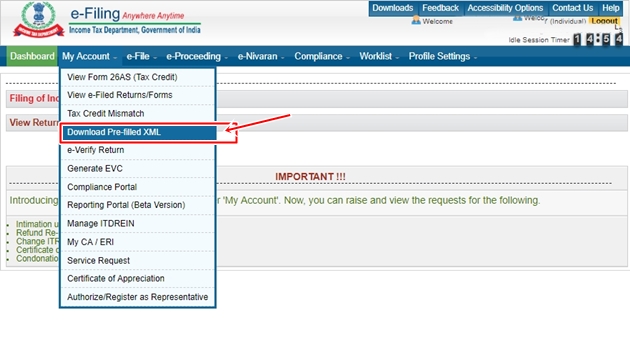

ET Online Step seven: Once logged in successfully, get to the 'My Account' dropdown bill of fare. Click on 'Download Pre-filled XML'.

ET Online

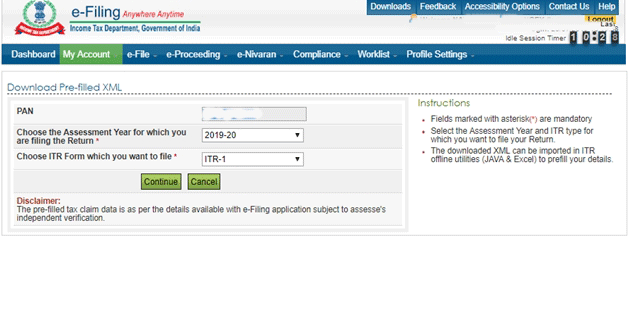

ET Online Step 8: Now you will be directed to 'Download Pre-filled XML' screen where your PAN volition be machine-populated. You will have to select the 'Assessment Year' for which you are filing the income tax return. From the second dropdown, choose the 'ITR Course' which you want to file. Afterward that, click on 'Go on' tab.

ET Online

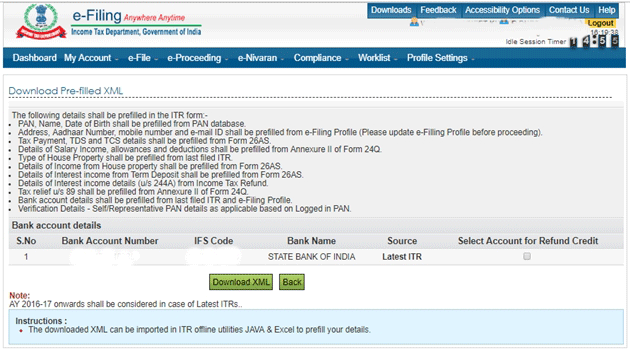

ET Online Step 9: Cull the bank account for credit refund. You are required to practise so irrespective of whether you have any refund or non. Later on that click on the 'Download XML' button to download the pre-filled XML file (The file volition go automatically downloaded in 'Downloads' folder of your organization).

ET Online

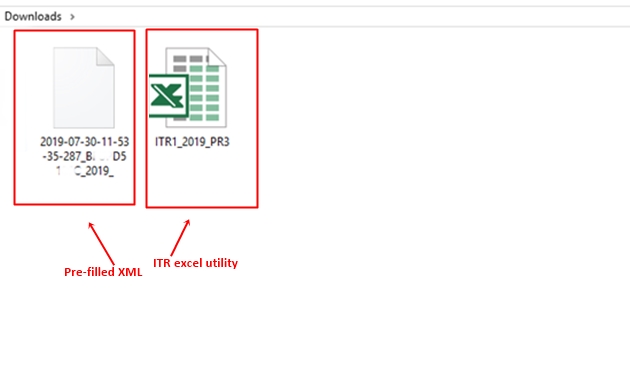

ET Online Step 10: At present both the ITR form and the prefilled XML file volition be downloaded in 'Downloads' folder of your organisation.

ET Online

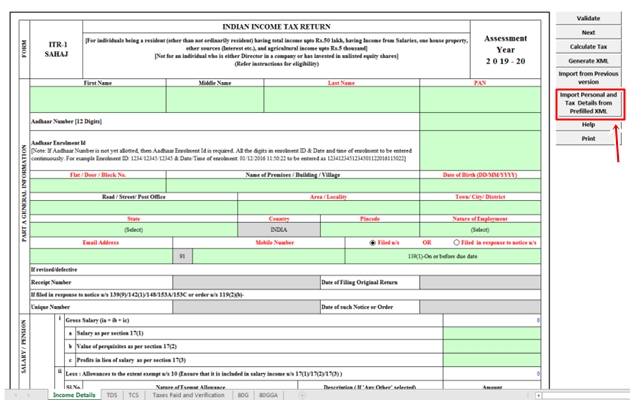

ET Online Stride 11: Open the downloaded ITR Excel utility (If not downloaded nonetheless, refer to footstep 1 to pace 4 above) and click 'Import Personal and Revenue enhancement Details from Prefilled XML' push from the correct-side panel of the full general data schedule of the ITR grade.

ET Online

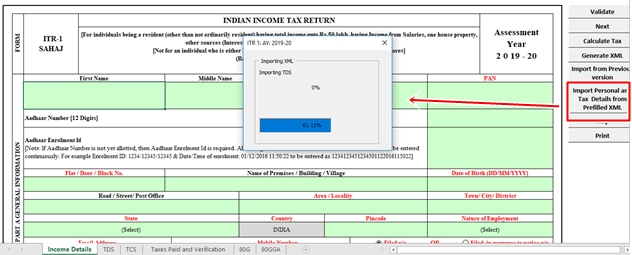

ET Online Footstep 12: Browse and select the downloaded prefilled XML file and click on 'Open' button and import the details to ITR Excel course.

ET Online

ET Online All the personal and revenue enhancement details available with tax e-filing portal will be prefilled into the appropriate ITR excel form. Save the information pre-filled in the form. However, call up that it is your responsibleness to check all the prefilled details earlier submitting and correct them if needed.

(Your legal guide on estate planning, inheritance, will and more.)

Download The Economic Times News App to become Daily Market Updates & Alive Business News.

Source: https://economictimes.indiatimes.com/wealth/tax/how-to-download-import-prefilled-xml-file-to-fill-tax-details-in-itr/articleshow/70492472.cms

0 Response to "Do We Need to Sign Excel Spreadsheet Itr2 Before Uploading Return India"

Postar um comentário